If you're considering starting dropshipping, one of the questions that you may be thinking about is: “Is dropshipping legal in my country?”

The short answer: Yes, dropshipping is legal in most countries.

But the rules are not the same everywhere.

Each country has its own laws about consumer protection, taxes, and importing products.

For example, what's perfectly fine in the United States might require extra paperwork in Germany or face high import taxes in Australia.

In this article, we'll look at the top 9 dropshipping markets and explain the most important rules you need to know in each one.

Let's get into it!

Disclaimer: We are not lawyers, and this post should not be considered legal advice. You should seek appropriate counsel for your own situation.

Is dropshipping legal? (An overview table)

Before we dive into the details, here's a quick overview of how dropshipping is treated in 9 of the world's most popular markets:

| Country | Legal status | What to consider | Learn more? |

| United States | ✅ Legal | FTC consumer protection, sales tax nexus, and product liability | Click here |

| United Kingdom | ✅ Legal | EU transparency rules, VAT obligations, and invoice requirements | Click here |

| Canada | ✅ Legal | GST/HST tax, import duties, consumer protection | Click here |

| Australia | ✅ Legal | 10% GST on imports, strong refund & warranty laws | Click here |

| Germany | ✅ Legal | EU consumer law, strict product compliance, VAT registration | Click here |

| France | ✅ Legal | GST registration, import restrictions, and payment gateway rules | Click here |

| India | ✅ Legal | High import taxes, customs delays, and a complex tax system | Click here |

| Singapore | ✅ Legal | Consumer protection law, low tax environment | Click here |

| United Arab Emirates (UAE) | ✅ Legal | VAT since 2018, ecommerce license (free zone vs mainland) | Click here |

1. United States

Good news: dropshipping is completely legal in the United States.

In fact, the US is one of the biggest and most beginner-friendly markets for dropshippers.

But just because it's legal doesn't mean you can ignore the rules.

If you want to build a business that lasts, there are a few key things you need to understand:

Consumer protection (FTC rules)

The Federal Trade Commission (FTC) is the leading agency that protects buyers.

This means:

- You must be honest in your product descriptions.

- You can't sell fake or counterfeit items.

- You're responsible if the product is dangerous or misleading, even if you didn't make it.

In short: don't overpromise, and don't sell low-quality items just because they're cheap.

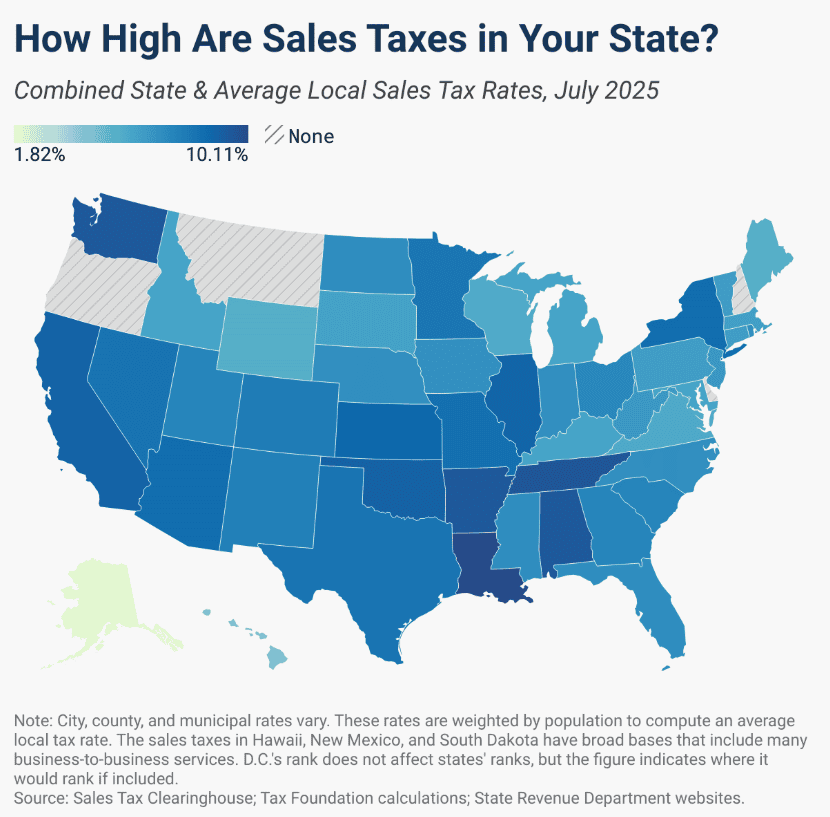

Sales tax (the tricky part)

The biggest challenge in the US is sales tax:

- Every state can decide if it needs to collect sales tax.

- If you have a “nexus” (a legal presence, such as an office, warehouse, or a certain amount of sales in a state), you must collect sales tax from customers in that state.

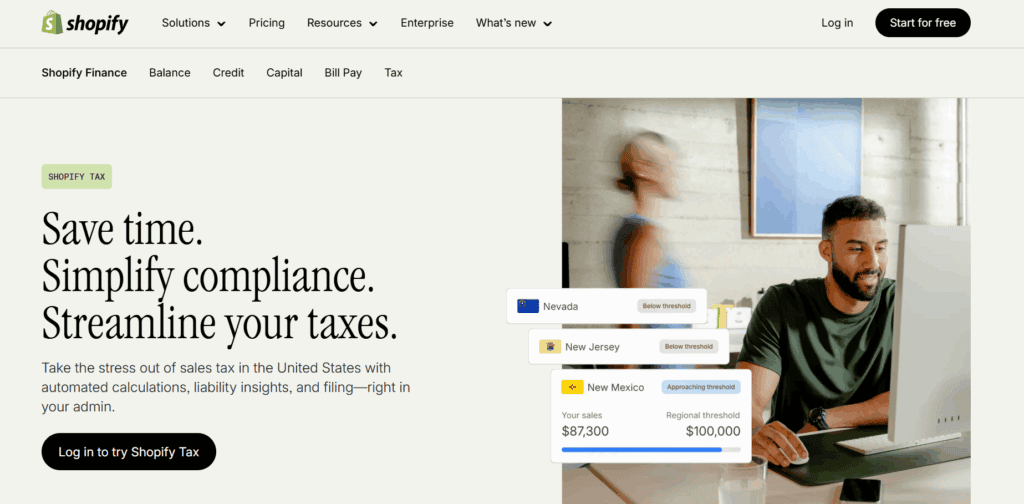

- Platforms like Shopify often help with automated tax collection, but you must still register correctly:

For example, if you live in California and make a lot of sales to customers in Texas, you might need to collect Texas sales tax, too, not just California's.

Start your store on Shopify

Free 3-day trial + $1/month for 3 months

- Grows with you from first test product to full brand

- 8,000+ apps & themes to customize your store

- Beginner-friendly editor with pro features when you're ready

No card to start. Cancel anytime.

Product liability

If something goes wrong with a product you sold (for example, a charger that catches fire), the customer can hold you legally responsible.

That's why it's smart to:

- Work only with reliable suppliers.

- Avoid risky categories, such as health supplements or electronics, unless you are thoroughly familiar with the regulations.

- Consider business insurance once you scale up.

Bottom line: Dropshipping in the US is legal and full of opportunities, but you need to stay on top of sales tax rules and ensure you're selling safe, legitimate products. If you play by the rules, the US is one of the best places to start dropshipping.

2. United Kingdom

Yes, dropshipping is legal in the UK.

But, as in most countries, there are rules you need to follow if you don't want to run into trouble.

The UK is a great dropshipping market because people often shop online; however, the government takes consumer protection and taxation very seriously.

Consumer rights (very strict in the UK)

UK shoppers are well-protected by law:

- Customers can cancel and return most online purchases within 14 days for a full refund.

- You must tell customers about shipping times, return policies, and refund options.

- If a product arrives faulty or not as described, you are responsible for resolving the issue, even if your supplier is located overseas.

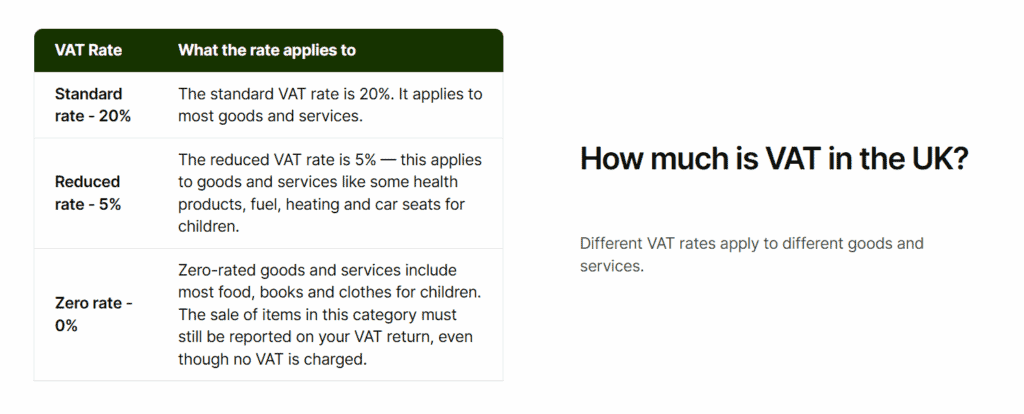

VAT (Value Added Tax)

This is similar to sales tax in the US:

- If your business makes more than £90,000 per year in sales, you must register for VAT.

- VAT is usually 20% and must be added to your product prices if you're registered.

Post-Brexit Customs

Since Brexit, selling from suppliers outside the UK (especially from the EU) comes with extra steps:

- Customers may need to pay import duties or VAT on deliveries from abroad.

- To keep buyers happy, many UK dropshippers use local UK suppliers for faster and smoother shipping.

Bottom line: Dropshipping in the UK is 100% legal, but you must comply with stringent consumer protection laws and be prepared for VAT and customs regulations.

3. Canada

Yes, dropshipping is legal in Canada.

It's actually a popular business model there, but like in the US and UK, you need to play by the rules.

Consumer protection

Canada has strong consumer protection laws, and they apply to online sellers too:

- Products must be safe and accurately described.

- Customers have the right to refunds or replacements if the product is defective or misleading.

- You are responsible for handling complaints.

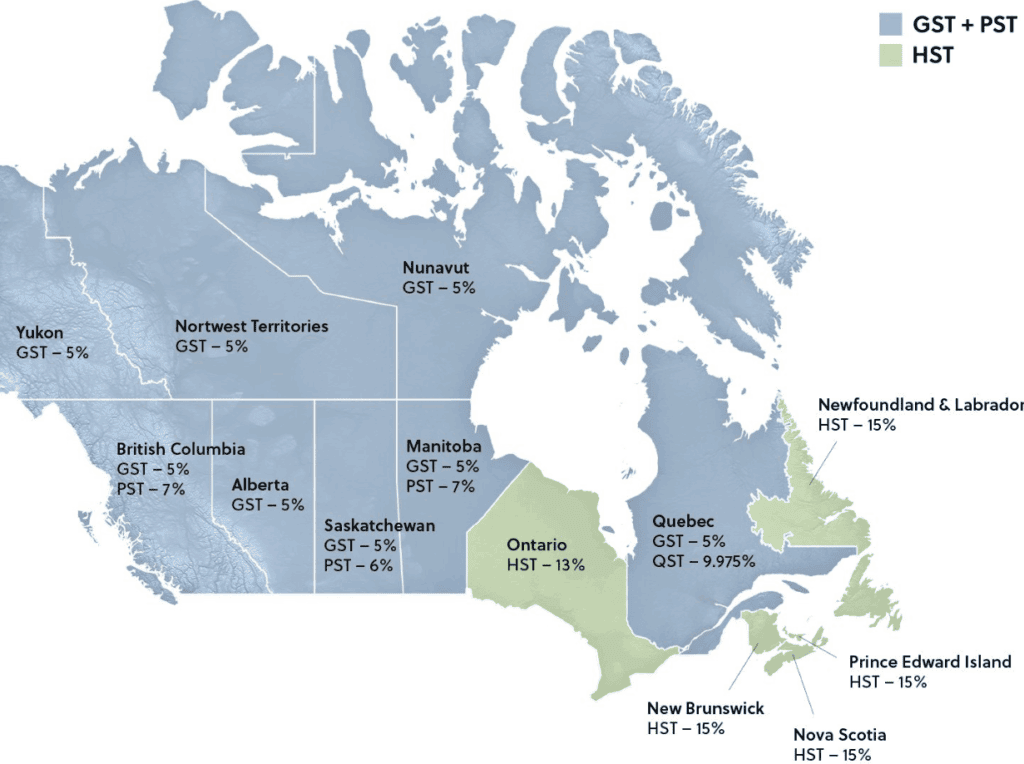

GST/HST (Sales tax in Canada)

Taxes in Canada work a little differently compared to the US:

- Canada uses GST (Goods and Services Tax) at 5%, plus HST (Harmonized Sales Tax) in certain provinces.

- If your sales exceed CAD $30,000 per year, you are required to register for GST/HST and charge it on all sales.

- Below that amount, you don't need to register, but many serious sellers do anyway to look professional and claim tax credits.

Customs and import duties

This is where some Canadian dropshippers run into problems:

- If your supplier ships from outside Canada (such as China or the US), the customer may be required to pay customs duties or import taxes upon arrival of the package.

- Long shipping times from overseas suppliers can also be frustrating for Canadian customers.

The solution?

Some dropshippers work with Canadian suppliers to ensure fast delivery and avoid customs surprises.

Bottom line: Dropshipping in Canada is legal and profitable, but you must handle GST/HST correctly and exercise caution when shipping from overseas. To keep your customers happy in Canada, ensure that delivery times are short and your return policy is straightforward.

4. Australia

Yes, dropshipping is legal in Australia.

In fact, it's a well-developed ecommerce market with plenty of opportunities.

However, to succeed here, you must understand how taxes and consumer rights work, as Australia is recognized for having some of the strongest buyer protection laws in the world.

Consumer protections (Australian Consumer Law)

The Australian Consumer Law (ACL) is very strict:

- Customers have the right to refunds, repairs, or replacements if the product is faulty or does not meet the description.

- You must clearly state your shipping times and return policies.

- Even if your supplier is overseas, you are responsible for fixing the issue.

For example, if a customer buys headphones from your store and they stop working after a week, you must provide a refund or replacement, even if your supplier is in China.

GST (Goods and Services Tax)

Taxes are another important point:

- Australia charges a 10% Goods and Services Tax (GST) on most goods sold to Australian customers.

- If your business generates more than AUD $75,000 per year, you are required to register for GST and charge it on your sales.

Bottom line: Dropshipping in Australia is legal, but you must respect strict consumer protection laws and handle GST correctly. If you're honest about delivery times and work with reliable suppliers (preferably local Australian suppliers), it can be a profitable market.

5. Germany

Yes, dropshipping is legal in Germany.

But Germany has some of the strictest consumer protection and tax rules in Europe.

German customers expect professionalism, transparency, and high-quality service.

Consumer protection (very strong in Germany)

Germany follows EU consumer protection laws, but often enforces them more strictly than other countries:

- Customers have a 14-day right of withdrawal, which means they can return most products within 14 days for a full refund.

- You must display your return policy, company details, and contact information on your website:

- Products must meet EU product safety standards (especially for electronics, toys, and health products).

For example, if you sell a children's toy without the proper CE certification, you could face legal fines.

Find local suppliers: 6 Best Dropshipping Suppliers in Germany (Free & Paid)

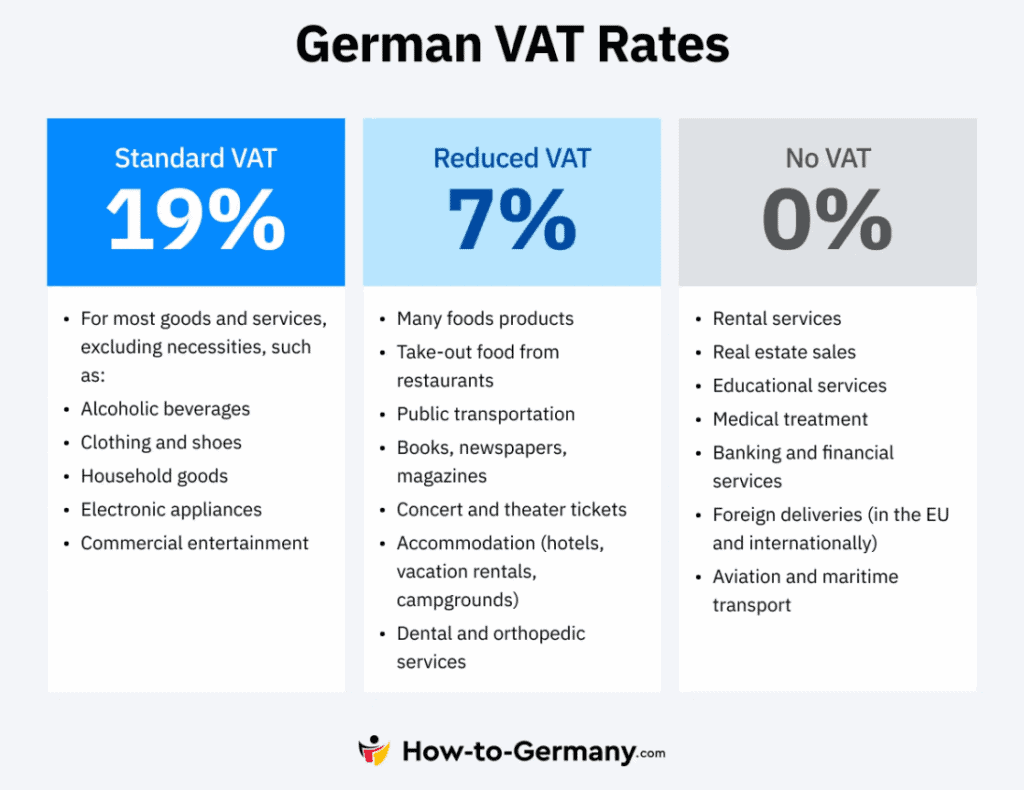

VAT (Value Added Tax)

Here's what you need to know:

- If you sell to German customers, you may need to charge 19% VAT (the standard rate).

- Once your sales cross the EU threshold (€10,000 annually for cross-border sales), you must register for VAT in the EU One-Stop-Shop (OSS) system.

- Even if you're not based in Germany, selling to German customers can still trigger VAT obligations.

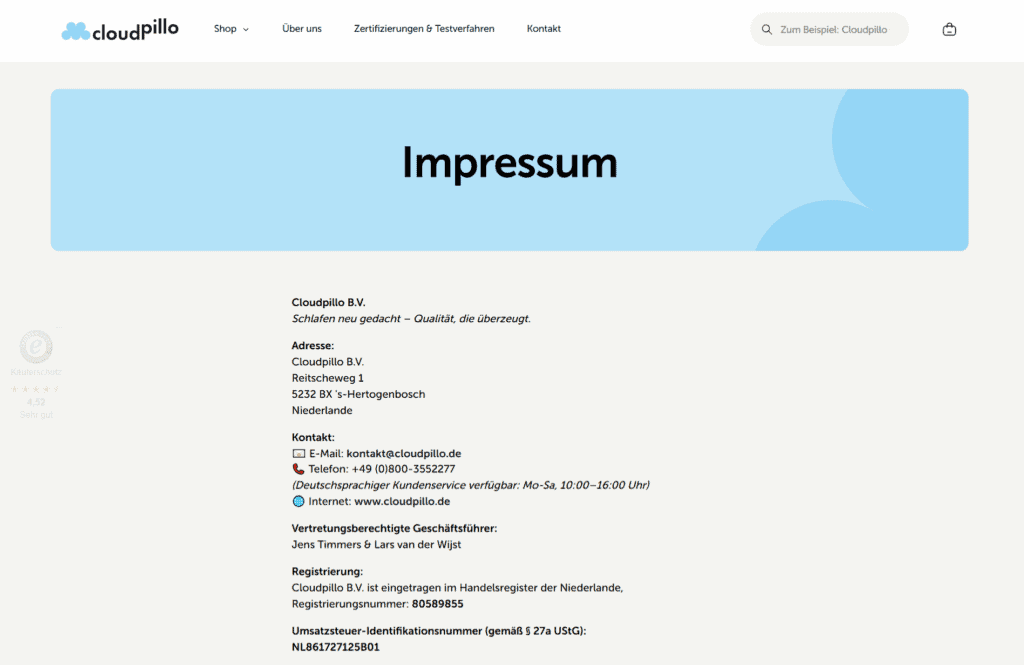

Business registration and transparency

German law requires online sellers to be very transparent:

- You must provide an Impressum (a legal notice page with your business address and contact details):

- Customers should know who they're buying from; anonymous dropshipping stores are not allowed.

- Failure to comply can result in “Abmahnungen” (legal warnings) from competitors or consumer protection groups, which can be expensive.

Bottom line: Dropshipping in Germany is legal, but not easy. You'll need to register for VAT, follow strict EU product and safety regulations, and provide full transparency regarding your business details.

If you do it right, Germany can be a profitable market with loyal, repeat customers; however, if you cut corners, you'll quickly run into legal trouble.

6. France

Yes, dropshipping is legal in France.

But, just like in Germany, France has strong consumer protection laws and very specific requirements for online sellers.

Consumer protection

French law, and EU law in general, is designed to protect buyers:

- Customers have a 14-day period to return most products for a full refund.

- You must inform customers about delivery times, return policies, and the identity of the seller.

- If an item is defective, arrives late, or does not match your description, you are responsible for requesting refunds or replacements.

For example, if your store says shipping takes 7 days but the product arrives in 30 days, the customer can demand a refund and even report you to consumer authorities.

Find local suppliers: 7 Best Dropshipping Suppliers in France (Free & Paid)

VAT (Value Added Tax)

In France:

- The standard VAT rate is 20%.

- If you're selling from outside France but to French customers, once you cross the EU-wide sales threshold (€10,000), you must register for the One-Stop-Shop (OSS) VAT system.

- Invoices must include VAT details if you are registered; French authorities closely monitor this requirement.

Legal website requirements

Your store should have:

- Mentions légales (legal notice page). This includes your business name, address, registration details, and contact information.

- Terms & Conditions (Conditions Générales de Vente). Explains how you handle sales, returns, and refunds.

- Privacy Policy. Required for handling customer data under GDPR (EU privacy law).

Bottom line: Dropshipping in France is legal and profitable, but you must be transparent and comply with EU tax and consumer laws.

7. India

Yes, dropshipping is legal in India.

But compared to places like the US or UK, running a dropshipping business here can be more complicated.

Consumer protection

India has strong consumer protection laws:

- You must be honest in your product descriptions and pricing.

- If a product is defective, damaged, or not delivered, you are responsible for refunds or replacements.

- Hidden costs (like surprise import duties) can lead to disputes and even penalties.

Find local suppliers: The 11 Best Dropshipping Suppliers in India (Free & Paid)

GST (Goods and Services Tax)

Taxes are a bit complex in India:

- You must register for GST if your annual turnover exceeds ₹20 lakh (approximately USD $24,000).

- Even if you make less, registering for GST is often required to work with marketplaces like Amazon India or Flipkart.

- GST rates depend on the product category (anywhere from 5% to 28%), but they're currently working on reforming the system to make it simpler:

Payment gateways

Another challenge is payment processing:

- Platforms like Shopify Payments and PayPal (commonly used by dropshippers abroad) are limited in India.

- You may need to use alternative payment gateways to accept payments from Indian customers.

- International payments can be more difficult due to Reserve Bank of India (RBI) regulations.

Bottom line: Dropshipping in India is legal, but more complex than in Western countries.

8. Singapore

Yes, dropshipping is legal in Singapore.

In fact, Singapore is known as one of the most business-friendly places in the world.

The rules here are straightforward, taxes are relatively low, and the government supports ecommerce growth.

That said, there are still a few things you need to know:

Consumer protection

Singapore has clear consumer protection laws under the Consumer Protection (Fair Trading) Act (CPFTA):

- You must be honest in your product descriptions and refrain from making false claims.

- Customers have the right to refunds or replacements if a product is defective or not delivered as promised.

- You are responsible for resolving disputes, even if your supplier is overseas.

Find local suppliers: Dropshipping in Singapore: Where to Find Suppliers? (2026)

GST taxes

Taxes in Singapore are relatively simple compared to other countries:

- The Goods and Services Tax (GST) is currently 9%.

- If your annual revenue exceeds SGD $1 million, you are required to register for GST and charge it to your customers.

- If you earn less than that, GST registration is optional. Most new dropshippers won't reach this threshold immediately, making Singapore an attractive option for starting small.

Bottom line: Dropshipping in Singapore is 100% legal, with a business-friendly environment and low barriers to entry.

9. UAE

Yes, dropshipping is legal in the UAE, and it has become one of the fastest-growing ecommerce hubs in the Middle East.

However, unlike some countries where you can start selling online with minimal setup, the UAE has specific rules regarding business licensing and taxes that must be followed.

Consumer protection

The UAE's consumer protection laws are becoming stricter as ecommerce grows:

- You must provide accurate product descriptions.

- Customers have the right to refunds if items are defective or not delivered as promised.

- As the seller, you are responsible for resolving complaints, not your supplier.

VAT (Value Added Tax)

The UAE introduced VAT in 2018, and it applies to ecommerce businesses too:

- The VAT rate is 5%.

- If your annual revenue exceeds AED 375,000, you are required to register for VAT.

- Even if you're below the threshold, registering voluntarily can sometimes be useful to look professional and reclaim VAT on expenses.

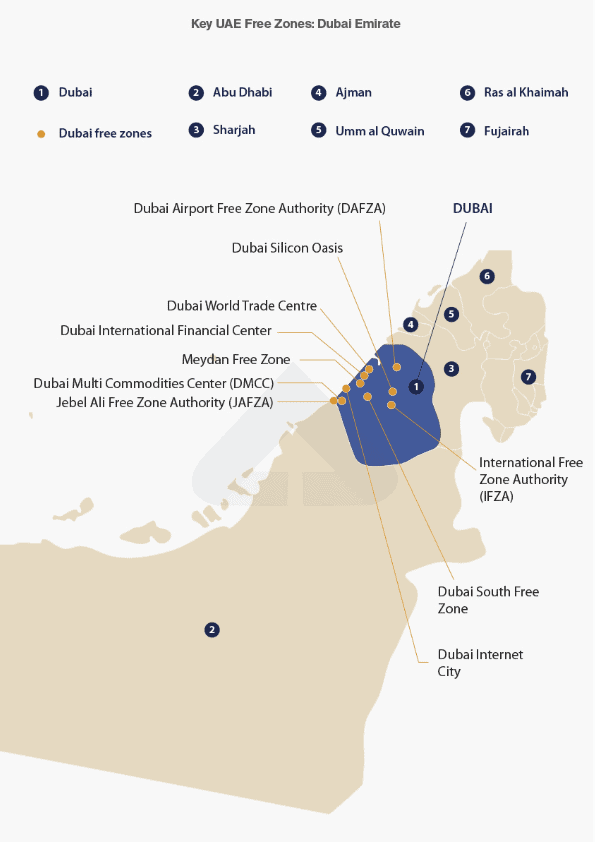

Licensing requirements

One of the biggest differences in the UAE is that you usually need a license to run an online business:

- To operate legally, you should apply for an ecommerce license.

- Licenses can be obtained in two ways:

- Mainland license. Allows you to sell directly in the UAE market.

- Free zone license. Cheaper and easier, but may limit your ability to trade locally unless you work with a distributor.

- The licensing cost can vary, but many entrepreneurs choose free zones because they are more flexible and business-friendly.

Bottom line: Dropshipping in the UAE is legal, but you will need an ecommerce license and may be required to register for VAT as your business expands.

Is there any country where dropshipping is not legal?

The simple answer is no; there is no country that has completely banned dropshipping.

The business model itself is legal worldwide.

However, in some countries, the barriers are so high that it can seem almost impossible to run a dropshipping store legally.

A few examples are:

- Nigeria and other parts of Africa. While dropshipping isn't illegal, many entrepreneurs struggle with unreliable payment gateways, weak logistics networks, and strict foreign exchange rules. This makes scaling very hard compared to Western markets.

- Turkey. The Turkish government has strict rules around import licensing and customs clearance. Long shipping delays, high import taxes, and constantly changing regulations can frustrate both sellers and buyers.

- Russia. Dropshipping is technically legal, but sanctions, payment restrictions (such as PayPal's limitations), and customs challenges make ecommerce extremely difficult.

- Argentina. High inflation, strict currency controls, and high import taxes make it challenging for dropshippers to remain profitable. Even if your store is legitimate, delivering products smoothly is a significant challenge.

- Saudi Arabia. Like the UAE, you need an official license to operate an online business.

Turn this guide into an AI checklist

Click your favorite AI tool below to get a short summary and step-by-step checklist based on this article.Prefer ChatGPT? Open this guide in ChatGPT with a pre-filled prompt (most readers start here).

Conclusion

So, is dropshipping legal in your country?

The answer is almost certainly yes.

However, as you've seen, the experience can vary significantly depending on where you live or where you intend to sell.

In places like the US, UK, or Singapore, dropshipping is relatively straightforward if you handle taxes and consumer rights properly.

But in countries such as Nigeria, Turkey, or Argentina, the additional challenges associated with payments, imports, or licenses can make it feel like it's illegal.

Have a great rest of your day!

Want to learn more about dropshipping?

Ready to move your dropshipping store to the next level? Check out the articles below:

- Is Dropshipping Legal in 2026? (Take a Look Here First)

- The Reality of Dropshipping: 6 Ugly Truths You Must Know

- 6 Tips to Not Get Sued When Dropshipping in 2026 (Must Read)

Plus, don't forget to check out our in-depth guide on how to start dropshipping here!