Starting a dropshipping business is exciting.

But there's one question many new entrepreneurs forget to ask:

What business structure should I use, Sole Proprietorship or LLC?

This choice might seem small, but it can have a huge impact on your business.

If you're not sure which one is right for you, you're in the right place.

In this article, I'll explain the difference between a Sole Proprietorship and an LLC, specifically for dropshipping businesses.

By the end, you'll know exactly which structure best suits your situation.

Let's get into it.

Run your dropshipping store on Shopify

Free 3-day trial + $1/month for 3 months

- Connect dropshipping apps and agents in a few clicks

- Automate orders, tracking, and payments in one dashboard

- Built to scale from first test product to full brand

No card to start. Cancel anytime.

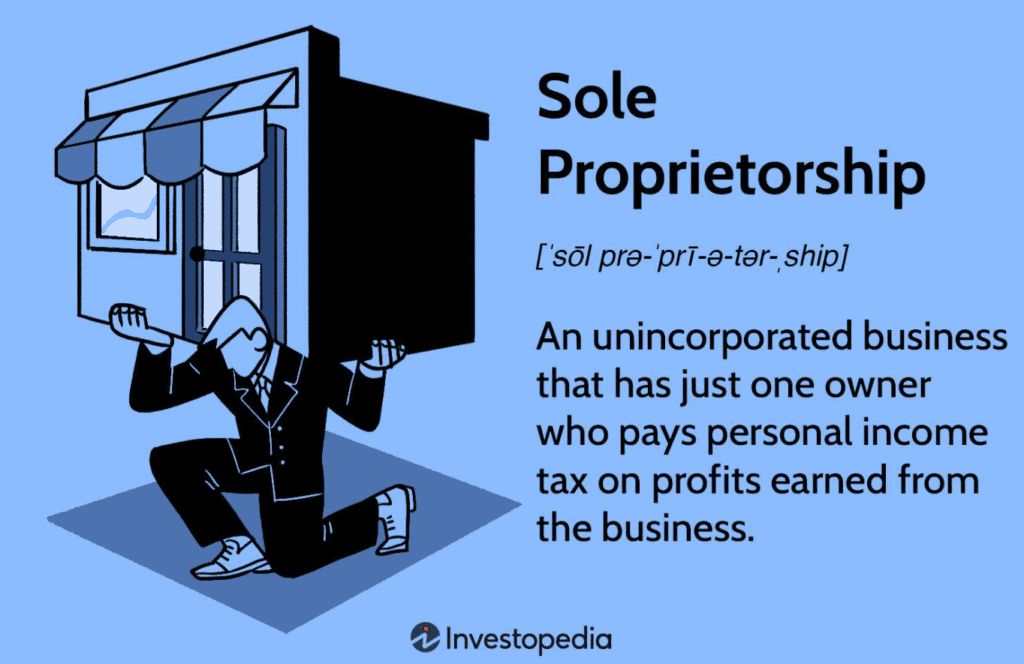

What is a Sole Proprietorship?

A sole proprietorship is the simplest and most common way to start a business.

In fact, if you start selling products online without officially registering your business, you're already considered a sole proprietor by default.

Pros

- Easy to start. You don't need to file any special paperwork (in most places) to become a sole proprietor.

Maybe you'll want to register a business name, also known as a DBA ("Doing Business As"), if you don't want to use your personal name.

But even that is a quick and low-cost process in most states or countries. - Low cost. There are almost no startup costs. You don't need to pay for an LLC registration, annual fees, or a business license (depending on where you live).

This is one reason why many people choose to begin their dropshipping journey as a sole proprietor. - Simple taxes. As a sole proprietor, your business income is treated as your personal income. You report your profits and losses on your personal tax return. You don't need to file a separate business tax return.

Cons

- No legal protection. This is the biggest downside of being a sole proprietor.

There's no separation between you and your business. That means if someone sues your business, your personal assets are at risk, like your savings, your car, and even your home in extreme cases.

For example, imagine a customer claims your product caused harm, or a supplier has a legal issue with you. As a sole proprietor, you're personally responsible. - Self-responsible for taxes. You'll likely need to pay self-employment tax, which includes Social Security and Medicare (if you're in the US). This can be a surprise if you're used to a traditional job where your employer handles that for you.

Best for

A sole proprietorship can be a great starting point if you're just testing dropshipping.

Maybe you're not making much money yet or are still learning how the business works.

It's fast, cheap, and easy.

In short: A sole proprietorship is like dipping your toe into the water. It's low risk to start, but it offers little protection if things go wrong.

What is an LLC (Limited Liability Company)?

An LLC, or Limited Liability Company, is a legal business structure that gives your dropshipping business its own identity, separate from you as a person.

That means your business is no longer just you running a store. It becomes its own legal "entity."

Pros

- Personal protection. The most important part of an LLC is in the name: Limited Liability. If something goes wrong in your business, you're usually not personally responsible. That's why many dropshippers choose an LLC once they start seeing traction.

Quick note: You still have to act responsibly. If you mix your personal and business finances or commit fraud, the “limited liability” can be removed. That's called piercing the corporate veil, and yes, it's as serious as it sounds.

- More credibility. Having an LLC makes your business look more professional. When you apply for a business bank account, payment processor (like Stripe or PayPal), or even reach out to suppliers, they're more likely to take you seriously if you're operating under an LLC.

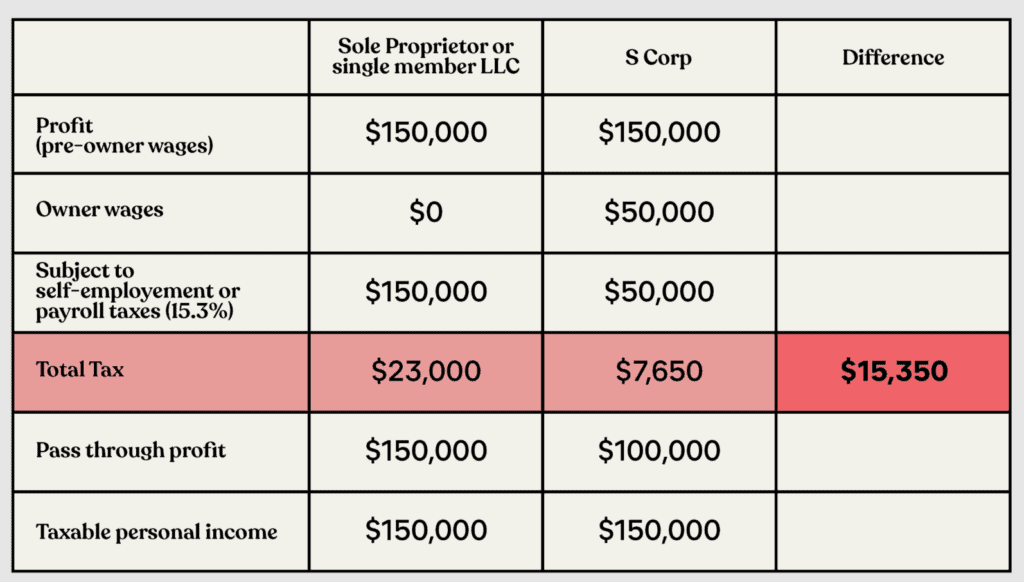

- Flexible taxes. By default, an LLC is taxed just like a sole proprietor. But as you grow, you can choose to be taxed as an S-Corporation (in the US), which may help you save money on self-employment taxes once you're making consistent income.

Cons

An LLC does come with a bit more work and responsibilities:

- You'll likely need to file formation documents with your state or country.

- There are startup costs (often between $50 and $500, depending on where you live).

- You may have to file annual reports, pay renewal fees, and keep better records.

It's not complicated, but it does require staying organized.

Best for

An LLC is ideal if:

- You're starting to make consistent sales (above $1k per month in profit).

- You're building a brand that you want to protect.

- You want to separate your personal life from your business.

- You're looking to scale your dropshipping store long-term.

In short: If you're making consistent profit and treating dropshipping like a real business, it's smart (and often safer) to form an LLC sooner rather than later.

Head-to-head comparison: Sole Proprietorship vs. LLC

Now that you know what a Sole Proprietorship and an LLC are, let's put them side-by-side.

This will help you see how the two business structures compare for a dropshipping business:

| Category | Sole Proprietorship | LLC |

| Setup time | Immediate (just start selling) | Slower (must file paperwork with the state) |

| Startup cost | $0-$50 (maybe a DBA fee) | $50-$500+ (depending on your location) |

| Legal protection | None (personal assets at risk) | Yes (separates personal and business assets) |

| Taxes | Simple (reported on personal tax return) | Flexible (can stick with personal or choose S-Corp) |

| Banking | Harder to get approved | Easier to get business bank accounts & Stripe/PayPal |

| Professional image | Less professional (just your name) | More credible (official business name) |

| Admin & paperwork | Minimal (few rules or filings) | Moderate, some ongoing requirements (varies by state) |

| Scalability | Limited (not built for growth) | High (better for growing and protecting a brand) |

| Branding power | Weak (usually under your personal name) | Strong (business name, legal presence, protection) |

5 Dropshipping-specific considerations

Now that you understand the general differences between a Sole Proprietorship and an LLC, let's examine five considerations that matter to you as a dropshipper:

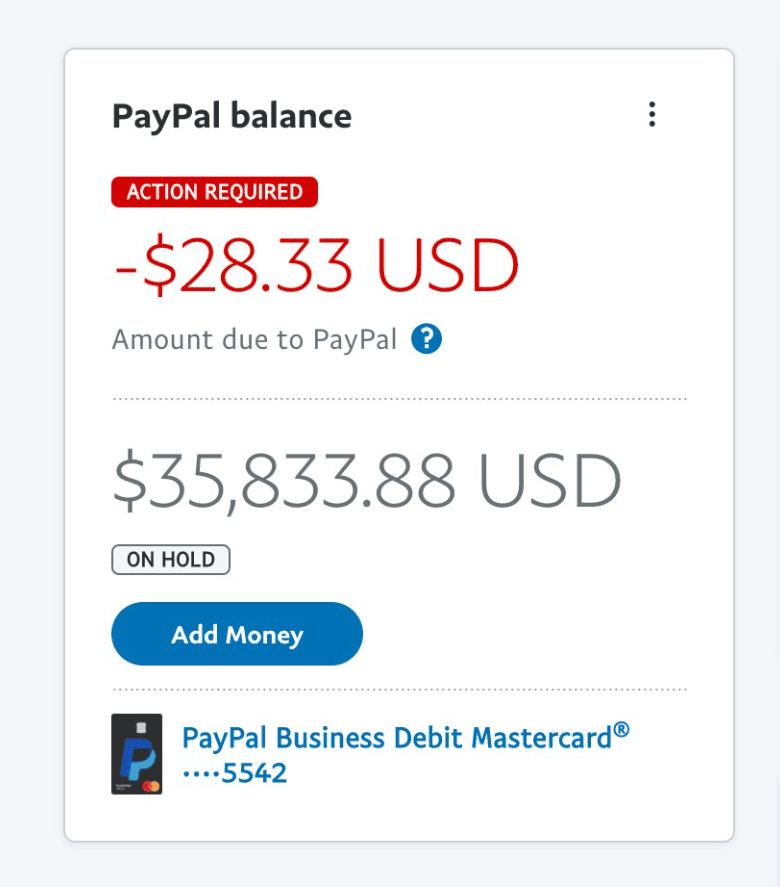

1. Payment processors (Stripe, PayPal, Shopify Payments)

This one's huge.

Payment processors are how you get paid, and they have strict rules. If your account gets flagged or frozen, your money can be locked up for months:

Here's what you need to know:

- Sole Proprietors often get more scrutiny. You're just an individual selling online.

- LLCs appear more legitimate. You have a business name, official documents, and a separate bank account. This builds trust with payment platforms.

Some processors even require an LLC or business EIN (Employer Identification Number) once your revenue hits a certain level.

So, if you plan to use Stripe or PayPal for serious sales, having an LLC reduces the risk of getting flagged and helps you get approved faster.

2. Supplier relationships

Many dropshippers rely on third-party suppliers, like Zendrop or private agents:

And guess what?

Suppliers take you more seriously when you're an LLC. They're more likely to:

- Offer better prices or faster shipping

- Be open to private labeling or custom packaging

- Share product data, like inventory and tracking tools

When you send them an email with “support@yourstore.com” and an LLC behind you, they know you mean business.

3. Returns, refunds, and disputes

In dropshipping, returns and chargebacks are part of the game.

Not every product works out. Customers get upset, and things go wrong.

- If you're a sole proprietor, you're personally responsible for any major customer complaints or legal claims.

- If you're an LLC, your personal assets are usually protected.

Also, having an LLC makes it easier to set up clear refund policies, hire a virtual assistant for support, and build a system that feels professional (not just like one person handling problems manually).

4. Business taxes & deductions

Both Sole Proprietors and LLCs can write off business expenses like Shopify subscriptions or Facebook Ads.

But with an LLC, you can elect S-Corp taxation (if you're in the US), saving you thousands per year by lowering self-employment tax (especially if your profits are over $50,000 per year).

5. Trust, branding, and growth

People buy from brands they trust.

Having an LLC shows your store is a real business. It lets you:

- Register a trademark

- Open a business bank account

- Apply for business credit cards

- Attract investors or partners (if you go big)

And let's not forget: Most successful 6- and 7-figure dropshipping brands operate as LLCs or corporations, not as individuals:

Common misconceptions to avoid

There is a lot of confusion about choosing between a sole proprietorship and an LLC.

You'll hear advice in YouTube videos and Reddit threads, but not all of it is true or helpful.

Here's an overview of the most common myths:

Misconception #1

I don't need an LLC unless I'm making a lot of money.

Reality:

You don't need to be rich to benefit from an LLC.

Even if you're making just $1,000/month, you're already exposed to risks like payment processor holds or supplier issues.

In this case, an LLC is like insurance; you hope you never need it, but you'll be glad you have it if something goes wrong.

Misconception #2

LLCs are expensive and complicated.

Reality:

Forming an LLC is actually pretty simple, and often cheaper than you think.

- In many US states, you can register an LLC for under $200.

- In some places, it's even less than $100.

- You don't need a lawyer; many people use affordable services for help or do it themselves online.

Misconception #3

If I register an LLC, I have to pay extra taxes.

Reality:

Not true for most people.

By default, an LLC is taxed just like a Sole Proprietor.

In fact, forming an LLC gives you more options to save on taxes later (like electing S-Corp status when you start making consistent profits).

Misconception #4

I can't form an LLC because I'm not in the US.

Reality:

You don't have to be a US resident to form a US-based LLC.

Tons of international dropshippers form LLCs in states like Wyoming or Delaware to:

- Use Stripe or PayPal

- Sell to US customers

- Build trust with suppliers

- Get better access to tools and platforms

Some services help with this process for non-residents. It takes a little more effort, but it's 100% possible, and often worth it.

Turn this guide into an AI checklist

Click your favorite AI tool below to get a short summary and step-by-step checklist based on this article.Prefer ChatGPT? Open this guide in ChatGPT with a pre-filled prompt (most readers start here).

Final verdict

Alright, now that you've seen both sides, here's the honest answer:

Both a Sole Proprietor and an LLC can work for dropshipping.

But which one is best for you depends on where you are in your journey.

Let's make it super clear:

Start a sole proprietorship if:

- You're just getting started and want to test things out

- You're making little to no money yet

- You want to keep things simple and low-cost

- You're not ready to commit fully (yet)

If you're running your store as a side hustle or you're still figuring things out, a Sole Proprietorship is fast, easy, and fine for short-term use.

However, switch to or start with an LLC if:

- You're starting to make consistent sales

- You want to protect your personal assets

- You're building a serious brand for the long term

- You're ready to scale

An LLC gives you the safety net, flexibility, and credibility you'll need as you grow.

And again, you can always start as a Sole Proprietor and upgrade to an LLC when the time is right!

Want to learn more about dropshipping?

Ready to move your dropshipping store to the next level? Check out the articles below:

- How to Start Dropshipping in 2026: Your 7-Step Guide

- Dropshipping Side Hustle: What to Know Before Starting

- Dropshipping: A Real Business, Not a Get-Rich-Quick Scheme

Plus, don't forget to check out our in-depth guide on how to start dropshipping here!